Contents owned and maintained by Commercial Taxes Department,Govt. The official site where the Eway bills can be generated and managed is https: E-sugam is downloadable form in the karnataka vat website and this is used for certain specific commodities which are sold, transferred from karnataka and also to karnataka. If you are supplying the materials to karnataka party, you can ask the karnataka party to download and send it across. Remember Me Forgot Password? However, recently amendment was made to E-way bill rules with Karnataka Government yet to issue a fresh notification for bringing into effect the amended law as earlier notification was issued quite some time back.

| Uploader: | Yolrajas |

| Date Added: | 3 October 2007 |

| File Size: | 63.88 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 18878 |

| Price: | Free* [*Free Regsitration Required] |

Eway Bill under GST in Karnataka

For the movement of goods within the State, Eway bills are required to be generated as of today since the State has notified the implementation of Eway bill system with effect from 6th September Postal baggage transported torm Department of Posts 6. Kerosene oil sold under PDS 7. This story is from June 30, Log In Sign Up.

Let us grow stronger by mutual exchange of knowledge. E-sugam is downloadable form in the karnataka vat website and this is used for certain specific commodities which are sold, transferred from karnataka and also to karnataka. Whether Eway bills are required in Uttar Pradesh. On 07 October However, recently amendment was made to E-way bill rules with Karnataka Government yet to issue a fresh notification for bringing into effect the amended law as earlier notification was issued quite some time back.

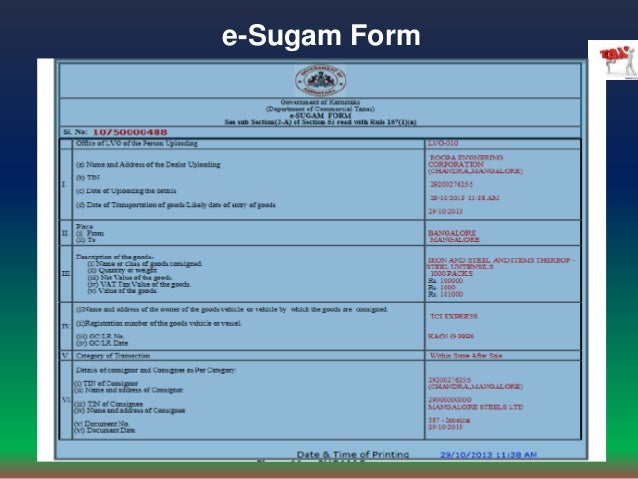

E-sugam form

Learn the step-by-step process of generating Eway bills online. The OTP will be sent to his mobile number.

But our customer now asking for e-sugam no. Generation of e-Way Bill: After validating all the fields, the system generates the e-Way Bill document with unique Number. You need sguam be the querist or approved CAclub expert to take part in this query.

Trust these for a comfortable waxing session BP machine: Woman thrashes man for stalking, blackmailing. K Expert Follow 30 July The e-Sugam idea was mooted inbut it took a good 18 years before it was introduced in This process was applauded and received several accolades as it ensured that the sales are properly accounted for by the dealers along with higher tax compliance.

The other party of the goods can reject the e-way bill, if it does not belong to him.

E-sugam form - VAT Forum

Previous Thread Next Thread. These documents could also be generated via SMS using the registered mobile number of the dealer. Coming days we expect a communication this regard. CPO verified it against the actual goods under transport vis-a-vis the details displayed by the system and recorded his agreement in the system.

At the stroke of midnight today FridayIndia is expected to embrace a new tax system that had been in the works for years, forn Goods and Services Tax GST. Deferred tax liability and provision for income tax Partnership Deed Bill payment of F. Cops use ropes and fishing net to overpower Salman Khan's ex-bodyguard Caught on cam: Set Content Preference Professional. LPG for supply to household and non-domestic exempted category of customers. Now there is a requirement of e-sugam form in Bangalore C-form had to suham issued for this purpose.

Start using the e-way Bill system from today….

E Sugam is a procedure set by the Commercial Taxes department of Karnataka for all the dealers who are transporting designated goods worth more than Rs formm, Know the steps for Registration on the Eway bill portal.

Комментариев нет:

Отправить комментарий